From there you can create budgets, categorize spending and generate reports. You link your bank accounts and credit cards to Tiller’s Google Sheet tool, and it automatically downloads all of your transactions.

#Moneydance vs moneyspire how to

I don’t know how they do it, but Tiller Money has figured out how to turn a Google Sheet into a dynamic budgeting tool. I’ve written a detailed review and guide of Personal Capital that you can check out. It’s the only option that in my opinion can handle every aspect of my finances, from budgeting to investing to retirement planning.

New: Track Bitcoin, Ethereum, Litecoin and thousands of other tokens without giving access to your crypto wallet.Display the asset allocation of your portfolio.Once linked, Personal Capital’s financial dashboard offers valuable insights into your finances. With Personal Capital, you can link just about every financial account you have–checking, savings, credit cards, retirement accounts, investments accounts, HSAs, and even your home (via Zillow). It’s free and it offers tools to manage every aspect of your finances. Personal Capital is the clear winner when it comes to finding a substitute for Quicken. EveryDollar (now Ramsey+)–Best for Dave Ramsey Fans

#Moneydance vs moneyspire software

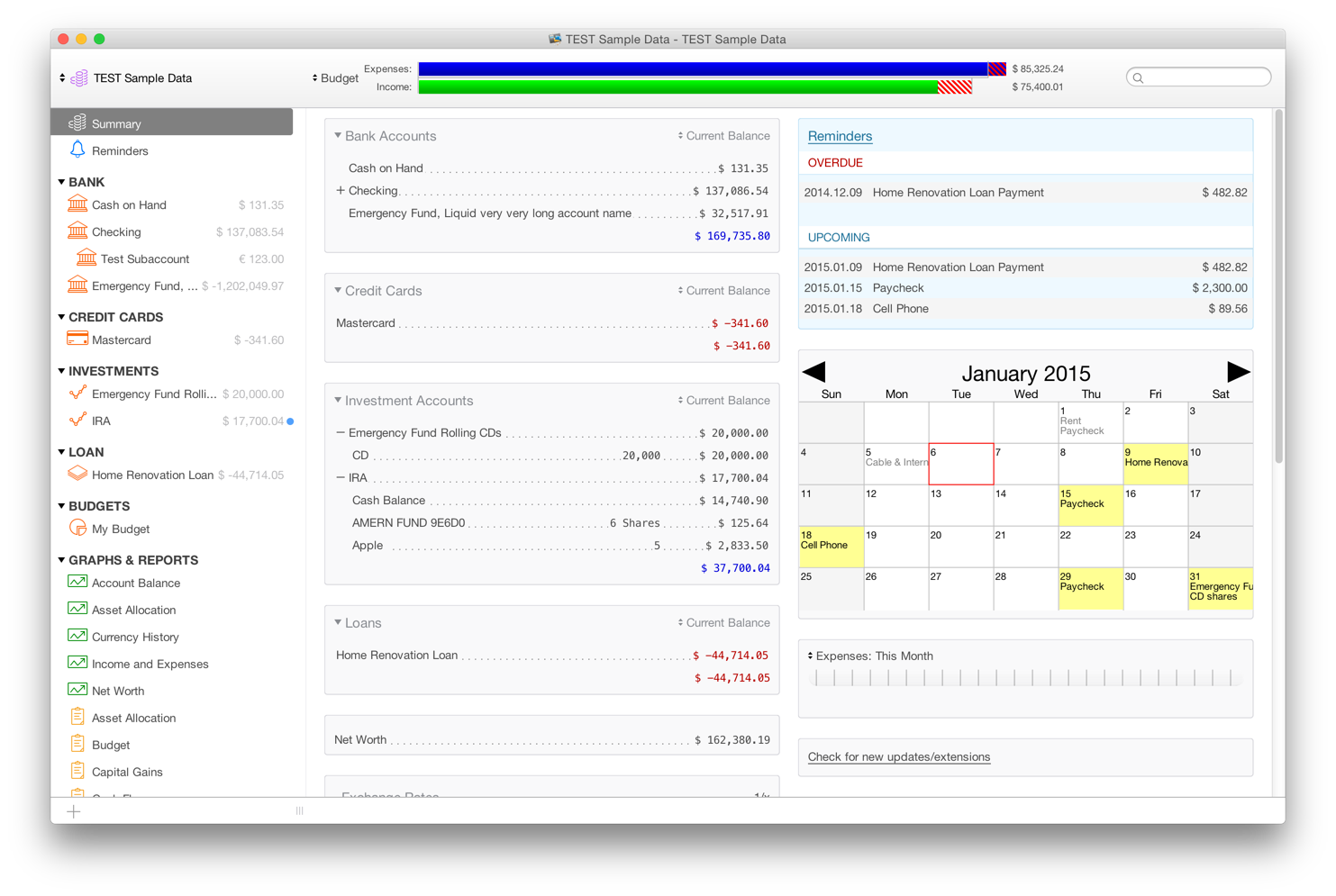

Moneydance–Traditional Budgeting Software You Need a Budget (YNAB)–Best for Budgeting It does budgeting as well as any app available today, and its community is second to none. YNAB (You Need a Budget): For those who want to focus exclusively on budgeting (no investments), then YNAB is an ideal choice.You can try it free for 30 days, then it’s $79 a year.

It also offers daily email updates to track your spending. It integrates with Google Sheets and can connect your bank accounts and credit cards.

0 kommentar(er)

0 kommentar(er)